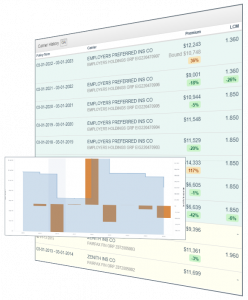

Are you reading the policy details? I mean READING them. I’m not talking about the rate or premium, or the cute badges that calculate the year-to-year change, or the carrier group color-coding. It’s the sum of all these parts, the big picture, and how it can make the difference in a quality sales call, in qualifying the opportunity and shaping perception. Here are some examples of what I see when looking at policy history:

Shot through the Heart (Arrow Mfr)

3 years of rate increases, bound at a 7% increase, but adjusted to a 22% decrease on our most recent update. What do you think happened? Good will on behalf of Hartford and the agent? Were the previous increases due to an uptick in the public’s archery interest, which has since faded?

Based on the modest increase, my guess is the renewal went out early, on auto-pilot. Competition was faced, and the incumbent got last look. I wonder what that competitor is thinking. Did he or she ask the insured if their payroll had doubled since 2019, early on in the process, to get the insured thinking about the bigger picture, not just ‘this renewal’.

Did they even know the current term premium for all lines, let alone historically?

I’ll never know, but I like to think they did not ask, did not know, and did barely any qualification (data shows it was retained by the agent). Just a ‘hey can I quote your insurance?’ kind of call, and the unthoughtful process that follows. Or the insured was a tremendous liar. It happens. That’s why we have a ‘hide’ flag.

Motel Hell

Employers since 2015, where they appear to secure the account at a 42% decrease. A 36% increase on the back of 3 relatively significant decreases. Current premium, 20% higher than it was bound 9 months ago.

This is a hotel. And if I had to guess, it’s haunted by a relatively savvy agent with a carrier consistently hot for the class that faces regular competition, because swings like this aren’t regular for a brick and mortar (not a touristed area).

That said, I have no idea. Maybe the insured didn’t fill out the renewal form a service rep sent out. The owner’s niece is the agent. We don’t know until we call. The point is – every policy term, every change, adds a little more context to this year’s opportunity, a way to validate or discredit perceptions.

Run Over

It looks like this insured has the same agents duking it out every couple of years. Berkley has done two stints, might still be on the Package lines considering Amerisafe is a mono-line WC market. So, the question on my mind is did a savvy incumbent strategically move the WC this year, or was it a competitor.

One thing to note is that Berkley clearly took a hit on the 19/20 term given the 25% mod jump 21/22. Based on this and the cancellation listed for the 22 term, my hunch is the incumbent agent was told to. Looking at their retirement, they’ve grown since 2018, coupled with the violations and consistent mod jumps, they’re experiencing some growing pains.

Looking at the class report we see this happens to be the 1 excavator Berkley has lost over the past year. One more click on their weblink reveals they do street/road work and underground utilities. Between this and the claims, AmeriSafe is quite a good home. Berkley does pretty well on Package lines that border E&S. Still, we never know until the call is made.