LCM

No, it’s not the least common multiple, it is the Loss Cost Multiplier, and it is probably the most descriptive name ever given. It is one of two numerical values that determines the policy rate for a given class code. As we learned in a previous post, Loss Costs are tied to the class code and based on state-level experience within the classification, in other words a constant.

The LCM is second of those two factors. It is filed by, and specific to the individual insurance carrier, also at the state-level. It allows them to adjust the ‘base’ rate (loss cost) for their own expense provisions, which is based on their individual underwriting experience (in that state). This makes it a variable.

The Loss Cost Multiplier is multiplied with the Loss Cost to determine policy rate, hence the name.

LC * LCM = Rate

Why is it Important?

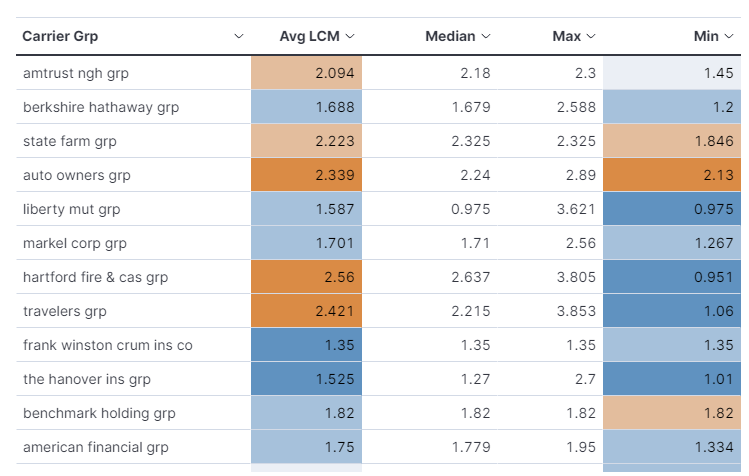

In our business, and sales in general, success and opportunity is measured on relative advantage. The LCM is the relative. If you have one WC carrier, and their LCM filing is 1.2, and the incumbent’s one and only LCM filing is 1.8 – you have a relative advantage over the incumbent because your policy rates will be about 33% lower.

From a pure price perspective, the story doesn’t end here. Many states also allow carriers to file a max and min scheduled rating (credit or debit), which offers a percentage discount or surcharge. Depending on market conditions this scheduled rating can appear to be ‘boilerplate’ – maxed out credit in a soft-market, maxed out debit in a hard market. This doesn’t throw the relative advantage out the window, it is just something to be aware of strategically, like those sweet back-end dividend programs.

What really makes it important is that you have a compelling reason for the prospect to hear you out and let you in (keep it simple, stupid). You are not the first producer to call that prospect, and odds are they all claim savings. So sure, you’re calling with the same reason, but you’re the first to explain how or why you can do it, that is what gives the prospect an actual reason to let you in.

And that is Xdate’s objective- get you in. It’s why we don’t just provide LCM info, we provide the historical values and competitive landscape at the class/state level in our reports, among other things. In an industry of unknowns, it only makes sense to start evaluation and base initial sales activities on what is known.

Carrier Appetite

Just because your carrier has a sick LCM filing doesn’t mean you’re going to beat the State Fund or pummel the Assigned Risk market. All carriers, yours included, have an ‘underwriting appetite’ – ranging in spectrum from highly desired to prohibited types of risk. This appetite can and typically does change throughout the year.

It changes because sometimes, underwriters go a little to hard on a limited number of classes or industries earlier in the year, and need to balance their risk portfolio come year-end. This in and of itself can present major opportunity, if you’re aware of it. At a high level your available markets’ collective appetite is something a Producer should be acutely aware of – at all times. If your carriers want retail, and you bring them roofers, that 1.10 LCM isn’t going to mean shit.

The point here is knowledge isn’t power, it’s how you use the knowledge that makes it powerful. So don’t disregard your markets’ appetite, combine it with your awareness of the competitive landscape and reap the rewards, or don’t and ruin your credibility with prospect and carrier alike.